News From the Louisville SBDC

MY TOP 3 TAX TIPS

Internal Revenue Service – The IRS is a great ally. They provide written publications that are easily accessible at www.irs.gov. My favorite is the Guide for Small Business, Publication 334. This document makes it easy for tax preparation of Schedule C or C-EZ users. The discussion of business expenses begins in Chapter 8 (page 31 of the 2016 edition.). This document is the Grand Prix for tax resources. If you opt for an app, check out IRS2Go. This app gives you daily tax tips, lets you know about tax legislation upon release, and connects you with a qualified tax person in your local area.

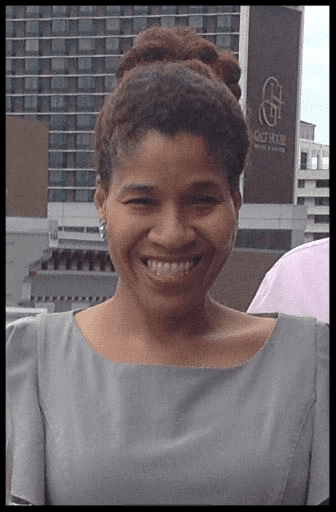

Toni Sears

Louisville SBDC Center

Bonus- Want another option for tracking receipts and generating reports on the go? Check out the app Shoeboxed Receipt Tracker. This mobile app links to your personal account on www.shoeboxed.com. This integration (web and mobile) is a powerful tool for tracking business expenses.

NEW PROGRAM HELPS KENTUCKY MANUFACTURERS GROW SALES AND PROFITS

- Contract proposal writing

- Iterating your business model and sales opportunities

- Marketing to the government

- Advice on pricing, subcontracting, GSA schedule, etc.

- Determining eligibility for certifications (8a, HUBZone, etc.)

SBDC and Access Ventures Create a Partnership to Help Finance Small Businesses

Dave Oetken

doetken@greaterlouisville.com

Louisville Small Business Development Center

502-625-0123

Upcoming Workshops

- Business Plan Boot Camp

February 20 – 22 (3 Nights)

6:00 pm – 9:00 pm

- Accounting Basics for the New Business Owner

March 7

9:00 am – 11:00 am

- Own Your own Business

March 11

8:00 am – 3:00 pm

- Grow Your Business with Email & Social Media

March 15

9:00 am – 11:00 am