If your identity was used, without your permission, to obtain a COVID-19 Economic Injury Disaster Loan (EIDL)… follow the procedures outlined below.

The US Small Business Administration has developed a process for individuals to report Identity Theft relating to fraudulent Economic Injury Disaster Loans (EIDL). If you have received a notice from SBA regarding an Economic Injury Disaster Loan (EIDL) which you did not apply for nor receive, you should follow the process outlined in this SBA guidance.

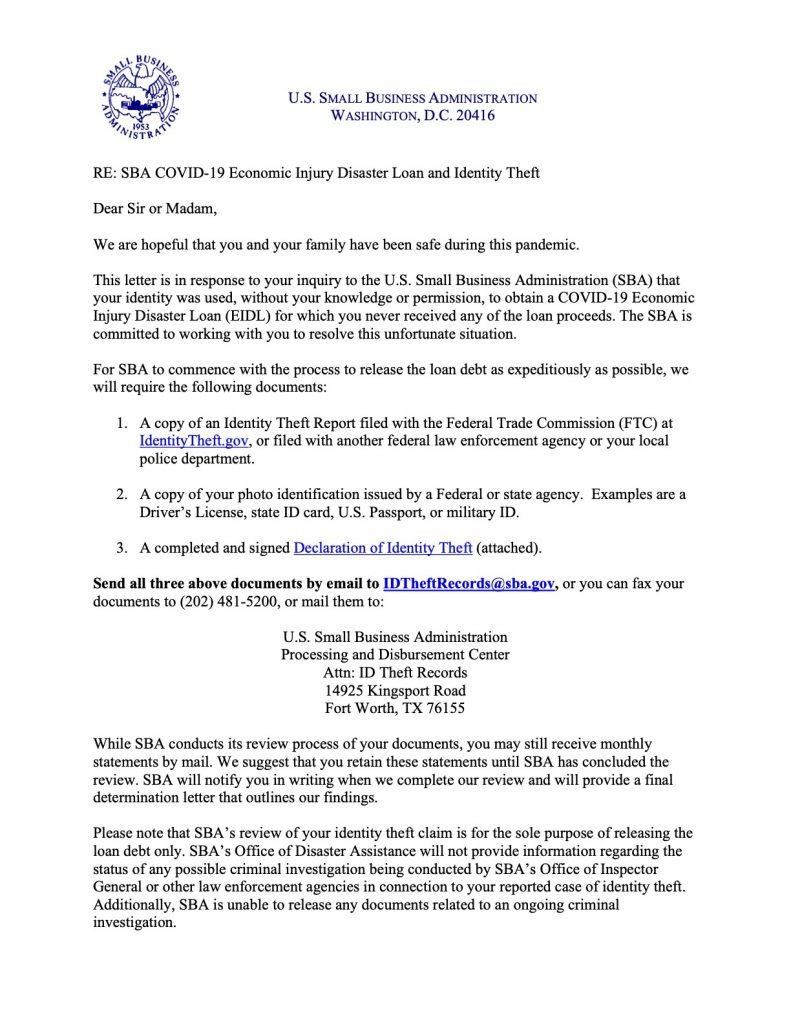

This letter is in response to your inquiry to the U.S. Small Business Administration (SBA) that your identity was used, without your knowledge or permission, to obtain a COVID-19 Economic Injury Disaster Loan (EIDL) for which you never received any of the loan proceeds. The SBA is committed to working with you to resolve this unfortunate situation.

For SBA to commence with the process to release the loan debt as expeditiously as possible, we will require the following documents:

A copy of an Identity Theft Report filed with the Federal Trade Commission (FTC) at IdentityTheft.gov, or filed with another federal law enforcement agency or your local police department.

A copy of your photo identification issued by a Federal or state agency. Examples are a Driver’s License, state ID card, U.S. Passport, or military ID.

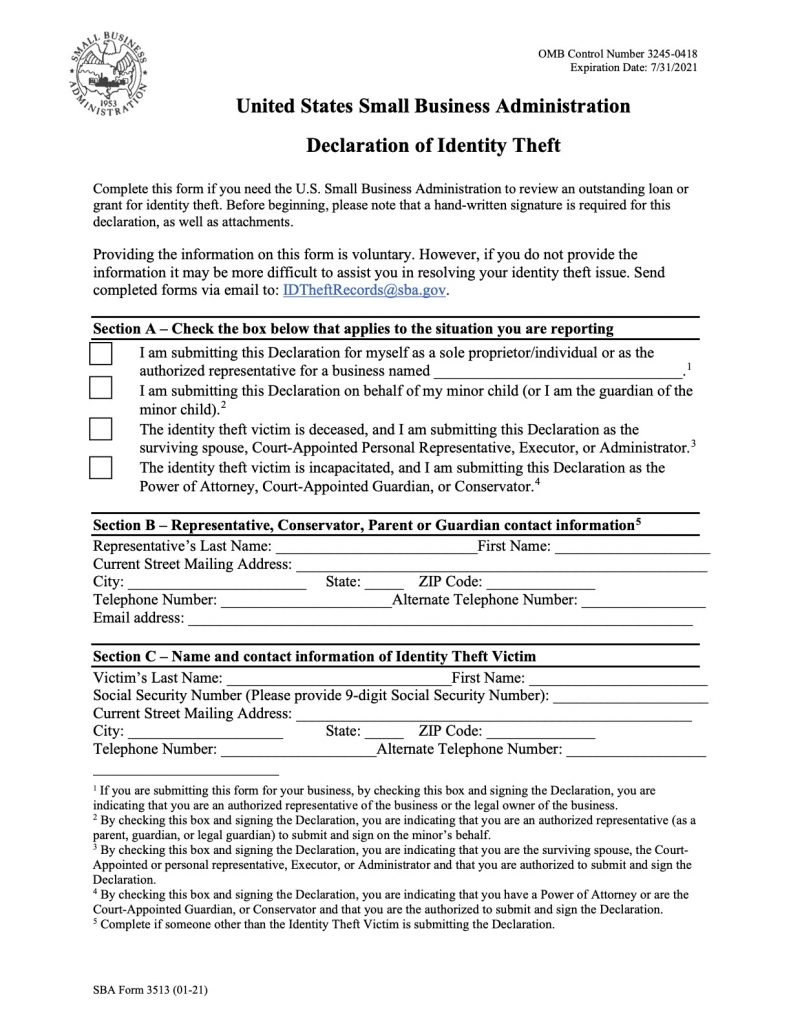

A completed and signed Declaration of Identity Theft (attached).

Send all three above documents by email to IDTheftRecords@sba.gov, or you can fax your documents to (202) 481-5200, or mail them to:

U.S. Small Business Administration Processing and Disbursement Center

Attn: ID Theft Records

14925 Kingsport Road

Fort Worth, TX 76155